Tax Identifiers in Small Parcel Suite

Overview

When shipping internationally, there are many cases where you need to provide a tax identifier for the customs documents. Small Parcel Suite allows these Tax IDs to be added to any international order for both the shipper and the buyer.

Editing Tax Identifiers in Small Parcel Suite

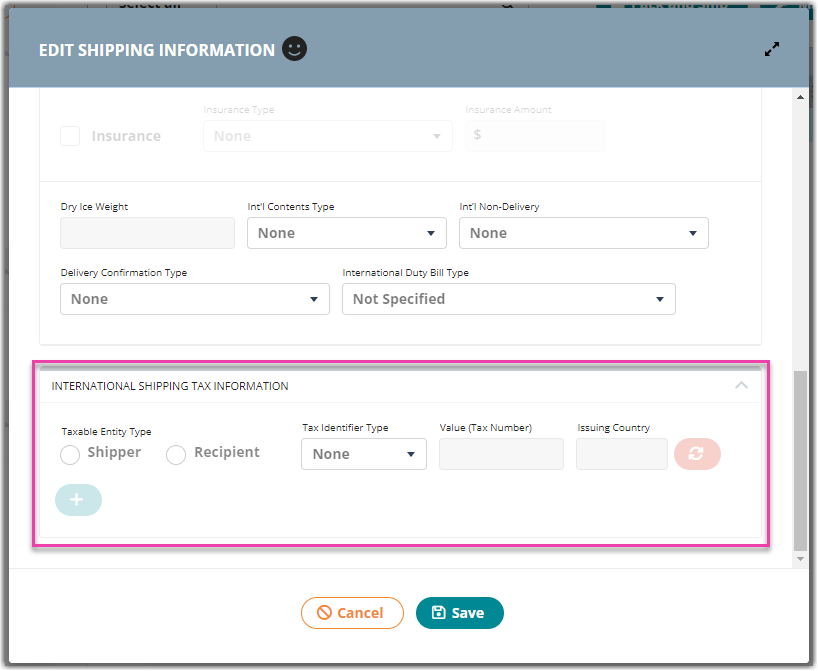

In the Small Parcel Suite grid, you can add and edit tax identifiers by clicking

Manage > Edit Shipping Info. At the bottom of the window, you will find the section to input your tax identifiers.

Required fields

When specifying your tax identifiers, you will be required to submit the following information:

-

Taxable Entity Type: The taxable entity type for this tax item. Valid values include the "Shipper" or "Recipient".

-

Tax Identifier Type: The tax identifier you are attaching to the shipment(s) (see next section for specific values that are accepted).

-

Value (Tax Number): The tax identifier number based on your selection.

- Issuing Country: The authority that issued this tax. This must be a valid 2-character ISO 3166 Alpha 2 country code.

Tax ID types

The following tax identifiers are supported in Small Parcel Suite. You may add multiple values to a single order as required.

-

EORI - Economic Operators Registration and Identification

-

VAT - Value Added Tax

-

IOSS - Import One-Stop Shop

-

VOEC - Norwegian Tax Administration

- TIN - Tax Identification Number

Using Custom Fields to Map Tax Identifiers

To dynamically map tax identifier information on each order, you can use custom fields. Please see this article for information on setting up custom fields. This will allow you to update your orders dynamically using the REST API or our import template.

For the Tax Identifier information, please use the following naming conventions for your custom fields:

- Taxable Entity Type

- Tax Identifier Type

- Tax Number Value

- Issuing Country

For the Taxable Entity Type and the Tax Identifier Type, please ensure that the information must be in lowercase.

If you wish to map multiple values, you can append a digit to each field (“Taxable Entity Type2”). Also, please ensure you match the description exactly for the fields above with spaces.

How your Tax Identifiers are used

When you assign a tax identifier in Small Parcel Suite, that information is transmitted securely to the carrier. For successful label requests you will also see your tax identifier printed on the commercial invoice.

Please see this help article for more information on generating commercial invoices and shipping internationally with Small parcel Suite.

If you have specific questions on the requirements of a specific carrier, please contact your account representative at the carrier for more information.